It represents the total amount of revenue the company earned during the period.Įxample: Global Tech Ltd. This information is available on the company’s income statement. Step #2: Find the net sales for the period you want to analyze. wants to compute the asset turnover for the fiscal year 2021-2022. Companies usually calculate it for either a quarter or the whole financial year.Įxample: Global Tech Ltd. Step #1: Determine the period for which you want to analyze the asset turnover. Here are the step-by-step instructions for calculating the asset turnover ratio:

FIXED ASSETS TURNOVER FORMULA HOW TO

How to Calculate the Asset Turnover Ratio Formula? You can use the following Asset Turnover Ratio Formula Calculator. Thus, Dow Chemicals is generating more revenue from its assets than SABIC. Therefore, SABIC has a lower ratio (0.63) than the industry average, while Dow Chemicals has a higher ratio (0.92). The industry average asset turnover ratio for the petrochemical (oil and gas) industry is 0.68. Step #1 Determine the average total assets We already have the data for the net sales, so let us determine the average total assets to calculate the asset turnover ratio. Let us calculate and interpret the results of each company’s asset turnover ratio. The table below gives their data for the year 2021-2022 (in millions). We take the example of SABIC (Saudi Basic Industries Corporation ) and Dow Chemical Company. Take a practical example of two companies operating in the petrochemical industry. However, it’s important to note that various factors can influence Amazon’s asset turnover ratio, such as the company’s size, product mix, and competitive landscape, which may differ from other e-commerce companies. It suggests that Amazon generates less revenue per dollar of assets than the industry average. The industry average asset turnover ratio for e-commerce businesses is 1.5. Step #2 Calculate the asset turnover ratioĪmazon has a 1.16 asset turnover ratio, meaning it generates $1.16 for each $1 asset it owns. Step #1 Calculate the average total assetsĪverage Total Assets = (Total Assets for the year 2021 + Total Assets for the year 2022) / 2 (Image Source: Amazon Annual Report 2022)įirst, we will calculate the average total assets and then the asset turnover ratio. We get the data for the year 2021-2022 from its annual report (its income statement and balance sheet). Let us determine the asset turnover ratio for Amazon Inc. Let us look at a few real company examples like Amazon, SABIC, etc.

It indicates that the company does not have an efficient asset management system. Thus the company’s asset ratio turnover is lower than the industry average. Hailey’s restaurant earns $1.57 for each dollar it has in assets. Let us calculate its asset turnover ratio. Hailey owns a restaurant named Taste the Best and wants to determine its efficiency in generating sales using its assets (restaurant building, equipment, inventory, etc.). It signifies that the company has efficient asset management.

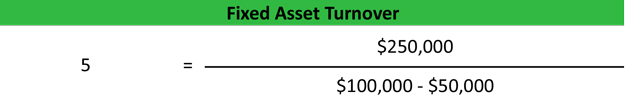

Thus the company’s asset ratio turnover is higher than the industry average. In the retail industry, the asset turnover benchmark is 2.5. has invested in assets, it generates $4 in sales. The asset turnover ratio of 4 indicates that for every $1 Dynamic Firms Ltd. Asset Turnover Ratio = Net Sales / Average Total Assets

0 kommentar(er)

0 kommentar(er)